Buying a house: The deposit, the mortgage, and why I couldn’t do it – an article on the BBC web site

This is an article by

The people featured usually do have an impressive commitment to the cause of property ownership, saying no to nights out and holidays in favour of basic, home-cooked meals, weekly budgeting and walking everywhere.

But often hidden further down in the piece is a mention of the kind of leg-up that many of us aren’t lucky enough to get: an inheritance from a grandparent or a well-paid role in the family business. Sometimes the person simply lives outside the UK’s most expensive areas.

Such articles can be met with laughter and anger on social media, as people point out that home-buying at a young age really isn’t as simple as having instant noodles for every meal.

Let’s look at some numbers.

The average earnings of 18-21 year olds is around £18,000 a year before tax, according to a government report from last year. If you’re between 22 and 29 years old, the average wage is almost £26,000.

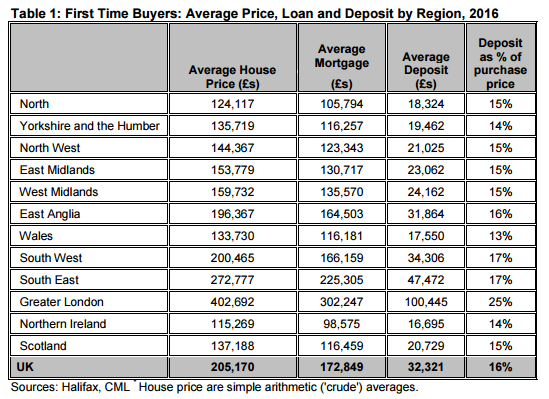

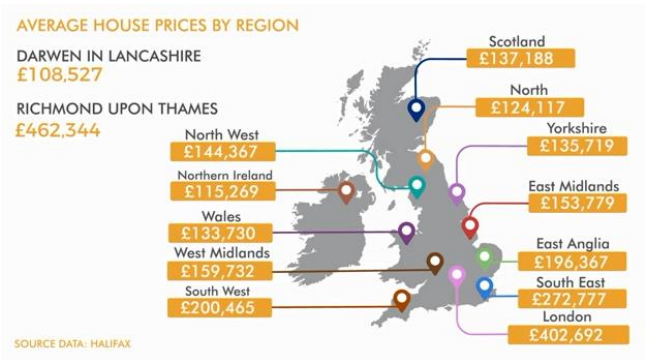

The average house price in the UK was £232,944 in October (and of course houses and flats are available for much less than this, depending on the area). Data shows a rise in the age of first-time buyers to around 30, and older in more expensive areas.

The typical rule for getting a mortgage is that banks will lend you up to 4.5 times your salary. Let’s take the average house price, and assume you have a 10% deposit of 23,000.

You’d need to earn almost £47,000 a year to take out a mortgage for the remaining cost – almost double the average wage for 22-29 year olds.

London, unsurprisingly, is consistently the most expensive place to buy in England and Wales. People there who want to own property can expect to spend up to 13 times their earnings on a home, while for people in North East England, it’s around 5.5 times.

Some areas in the North West are even cheaper – in Blackpool, for example, you could pick up a flat for just over £66,000 or a terraced house for £89,000. But wages there are some of the lowest in the UK, at around £19,700.

‘Want to buy a house? Choose your parents well!’

Buying agent Henry Pryor, a former estate agent who now helps people buy luxury properties, says the market is tough – but your mum and dad’s generation didn’t necessarily have it easier.

“If you want to become a homeowner, you’ve got to choose your parents well,” he jokes. “We have this view that it’s much harder to buy a house now, but I say that’s not quite right. Forty years ago, you couldn’t get a mortgage without a 25% deposit, and interest rates were 15%. Now they’re around 2%.”

He does concede, though, that “it is very hard now – it can be almost impossible for people who don’t have help.”

He does concede, though, that “it is very hard now – it can be almost impossible for people who don’t have help.”

[Brad Bamfield, Joint Equity CEO, says ” Thea illustrates the salary multiple problem well and its true that having parents who can help financially may make the difference but what happens if you do not have a Mum or Dad who can help? This is where Joint Equity becomes a good alternative where we become your Partner and provide that missing support]

Comment from Joint Equity – apart from the salary multiple problem above there are other costs and pitfalls involved some of which Thea reports below. Joint Equity is the buyers’ partner and we have extensive knowledge of and lead the buying process (we buy homes all the time and you will buy 2 or 3 times in your life) – just another headache we remove and reason we are so popular.

‘The stress put me off buying’

Emma, 25, from Nottingham, thought she’d struck gold when she came across a block in Nottingham city centre, where flats were being sold for £100,000 and only a 5% deposit (£5,000) was needed.

“I moved to Oxford after university with a previous boyfriend,” Emma explains. “Even though the relationship didn’t work, the job did, and I stayed there for over two years. Renting in Oxford is so expensive, I couldn’t think about saving. The flat I shared with my ex cost us around £700 a month each. I’ve heard people say living in Oxford is like paying London prices, but not getting a London salary, and I learned that the hard way!”

CONTRIBUTOR IMAGE The Nottingham flat Emma was going to buy

Emma went on to share a flat with a friend, which cost around the same price as before, but when the tenancy ran out she decided to return to Nottingham, where housing was cheaper. She found a job in PR where she earns “under £30,000”, she says – so her earnings are average for her age.

Emma realises she is lucky to live in a location where property is a bit cheaper, and to have a parent who can afford to help her out. For people earning a mid-range salary of around £24,000 in Nottingham, a city centre flat like the one Emma wanted is affordable.

But the bank wouldn’t give her a mortgage because “too many other flats in the building were rented,” she explains. “So many had been bought by private landlords and rented out. So if I wasn’t able to keep up with my payments it would probably make it harder for the mortgage company to then resell it and get the money back.”

“Some mortgage lenders get jumpy if there are lots of renters or Airbnbs in the building,” explains Henry. “They can also refuse a mortgage on buildings made of certain concrete, and sometimes people don’t find this out until too late. There are lots of reasons a mortgage might be refused.”

Emma then found another, similar flat in the same price range, in a smaller block. Her offer was accepted by the seller, and her solicitors began the process of the sale.

“The extra costs were a surprise,” Emma adds. “I was quoted £2,000 for a solicitor, which is around average, but I paid £125 up front, and didn’t have to pay the rest until I’d actually bought the flat. Then there was the mortgage broker – that was £350, but I only paid half up front. The searches and surveys were probably another £300.”

“Remember you’ll have legal bills and you’ll need money for them on top of the deposit,” says Henry. “If you want an extra survey, that might be an extra £1,000. Homebuyer’s insurance – to get money back if something goes wrong – could be about £50. If you’re not prepared, it’s like saying ‘I want to buy a car, but I didn’t know you have to insure it!'”

Six months later, the solicitors still hadn’t progressed, and Emma’s mortgage offer expired. If she wanted to try another bank, she’d have to pay more costs – something she didn’t want to do, because she’d already eaten into her savings.

“The stress of it has put me off buying for a while,” Emma says. “It’s meant to be this exciting thing you do – I was 24 and single and it was a really good feeling. But the fact it took so long and all fell through, I don’t know if I want to go through this again at the moment. When I do try again I might look outside the city centre.”

Emma is still living with her mum, but plans to rent a flat with her boyfriend in the near future. She knows she’s one of the lucky ones, and that buying a property is still within her reach once she saves up the money she lost – something she can do on her salary. But for some, buying looks impossible.

Joint Equity is always looking for new ways to help people move into their own home. Register as a Resident Partner (click here) and be first to know how we can help you achieve your own home with all the security it provides

Home ownership impossible for one in four young Brits says Halifax Building Society Report

Home ownership has sailed for one in four young Brits says Halifax Building Society Report

The headlines from the report:-

- There are approximately 19.5M young Brits in the UK.

- 25% (4.8M) of 18-34 year-olds are relying on inheritance to get on the property ladder

- One in 10 (1.9M) young people would leave the UK for a more affordable home

- 25% (4.8M) are certain they’ll never own their own home

- One in five (3.9M) says home ownership is a thing of the past

Almost half (48%) of young Brits think it’s harder than ever to get on the property ladder, with one in 10 prepared to leave the UK in order to buy their own home.

New research from the Halifax uncovered the attitudes of young people who don’t own a property, revealing that a quarter of 18-34-year-olds think the only way they’ll manage is by inheriting the cash.

uncovered the attitudes of young people who don’t own a property, revealing that a quarter of 18-34-year-olds think the only way they’ll manage is by inheriting the cash.

Eight out of 10 feel that a lack of affordable property is keeping home ownership out of reach, and as a result one in 10 (14%) think they’ll need to rent forever.

However, first-time buyers end up on average £651 a year better off buying than renting.

Despite the number of first-time buyers reaching a 10-year high of 339,0001 in 2016, half of 18-34-year-olds don’t think home ownership is a realistic option for their generation – with two thirds (65% or 12.6M people) saying they don’t earn enough to afford it.

Unsurprisingly, deposits remain too unrealistic and expensive for more than half (52%) of young people as the average age of those buying their first home has crept slowly up to 30.

More than half of young people feel that the average house price for a first home in their area is currently unrealistic for them, causing generation rent to think about relocating to boost their chances of buying.

One in five (22%) 25-34 year-olds would move to a cheaper area and even more of their younger counterparts aged 18 to 24 would be prepared to pack their bags for a bargain home elsewhere in the UK.

One in five (22%) 25-34 year-olds would move to a cheaper area and even more of their younger counterparts aged 18 to 24 would be prepared to pack their bags for a bargain home elsewhere in the UK.

The average deposit put down for an average first-time buyer home is £32,3212 , rocketing to £100,445 in London. Northern Ireland has the lowest at £16,695 – less than half of the average deposit needed in the South East (£47,472).

Martin Ellis, Halifax housing economist, said: “Even with the highest number of first-time buyers in the last decade in 2016, many young people still feel they are running financial gauntlet – saving for a deposit, finding an affordable property in the right area and managing to fund living in the meantime.

“It’s never too early to do some research to help build a better understanding of how much is affordable, the borrowing options available and calculating what’s achievable to help make owning a property more of a reality.”

Although aspiring homeowners could begin gravitating towards the UK’s more affordable areas to get on to the property ladder, more than one in five (22%) feel that home ownership is a thing of the past.

Even if they have managed to raise a deposit, a third (33%) feel mortgage criteria is too difficult for them to meet.

Brad Bamfield, founder and CEO of Joint Equity, said

“this supports the feeling of many in the property industry that young people have been “put off” owning their own home. Our evidence from the emails we receive is quite the opposite where the desire to own is stronger than ever its just that over regulation and the movement to the so called risk adverse lending in the industry has led to fewer opportunities for buyers.”

Joint Equity has been supporting the First Time Buyers, Divorced and Separated and Retired Renting to make the first steps in home ownership since 2007.”

Brad continued “today we need a range of products to serve the home owning aspirations of people today and unfortunately our finance industry is so frightened of new approaches and products that they will find every excuse not to do something and it’s people excluded from the market that suffer and are driven into the clutches of unscrupulous landlords and their letting agents.”

How does Government schemes to help home buyers compare to Joint Equity

If you’re one of millions of people that don’t have access to family financial support, there are a range of Government Schemes to help you take your first step on the ladder and we outline the key points below.

Then we look at the Joint Equity Shared Home Ownership scheme for comparison. Well we would wouldn’t we!

Help to Buy

First-time buyers can open a Help to Buy ISA, which gives a 25% government bonus on amounts saved between £1,600 and £12,000 – although the bonus is capped at £3,000.

First-time buyers can open a Help to Buy ISA, which gives a 25% government bonus on amounts saved between £1,600 and £12,000 – although the bonus is capped at £3,000.

It can be used for any property costing under £250,000 (£450,000 in London) and any mortgage.

You can save up to £1,000 in your first month, then up to £200 a month after that. You can choose to pay in less if you want, and it’ll still work.

Help to buy ISAs are only available to individuals. If you’re buying together, you can separately claim the government bonuses on your savings – and then combine the two to form a joint deposit.

Things to note:

- The deadline to open an account is December 2019. In April 2017, help to buy will relaunch to become the government’s lifetime ISA . But you will be able to shift your money across tax-free.

- It’s a monthly saving scheme but if you miss a contribution one month, you can’t make up for it in the following month (the cap is £200).

- If you’re buying together, but one of you is already a home owner. The first time buyer can still open an account.

- You need to get your solicitor to apply for the bonus when you buy a home. Alternatively, you can take the money out at any point, but if you choose this, you won’t qualify for the bonus.

- If you’re saving into a help to buy ISA you can’t save into another cash ISA in the same tax year.

More on Help to Buy ISA http://www.moneysavingexpert.com/savings/help-to-buy-ISA

Help to Buy Equity Loan.

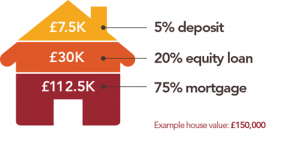

The remaining part of help to buy scheme is called the Equity Loan. It requires a minimum 5% deposit of the property value with the government offering an interest-free loan of a further 20%. The remaining 75% is covered by a standard mortgage.

As Zoopla explains, to buy a £200,000 property under the equity loan scheme, you’d need a minimum deposit of £10,000 and to qualify for a £150,000 mortgage. The government then provides an equity loan of £40,000.

- There is no interest to pay for the first 5 years.

- In year 6, interest (known as a ‘loan fee’) kicks in at 1.75%.

- The rate increases every year thereafter at the RPI (retail prices index) measure of inflation plus 1%.

- The idea with the help to buy equity loan is that, because you’re theoretically only borrowing 75% from the mortgage lender, rates will be cheaper than on a 95% mortgage. But don’t assume that’s always the case.

- When you come to sell your home, the government will take back its 20% share of the sale price.

This option is only available on new-build properties worth up to £600,000. The scheme will remain open until 2020.

Lifetime ISA

In his 2016 Budget, Philip Hammond announced a new lifetime ISA which will launch in April 2017. This will replace the current help to buy ISA – you’ll be able to shift your money across tax-free.

- You can only save a maximum of £4,000 a year

- The account offers a tax-free boost of up to £1,000 a year towards either buying your first home or saving towards retirement.

- Savers aged 40 or under can open these accounts, which will become available from April 2017. You can put away up to £4,000 each year. The government will then boost returns by 25p for every £1 saved at the end of each tax year.

- If you’re a first time buyer, you can then opt to use your lifetime ISA cash as a deposit on a property worth up to £450,000.

- If you save the maximum for 5 years you will have £20,000 + £4,000 bonus

Finally the penalty – if you save £1,000 the Government will give you £250 seems a good deal (but remember the maximum you can get is £1,000 bonus a year not to be sniffed at but not its not huge sums) and if you need the cash for any other purpose than buying a home you have to pay a penalty of 25%.

But here is the rub its calculated on 25% of the total which is £1,250 and so the penalty is £312.50 leaving you just £937.50 or £62.50 less than you saved. That is the penalty you pay.

So beware taking your money out for any reason other than buying a home or at retirment is costly

More Lifetime ISA http://www.moneysavingexpert.com/savings/lifetime-ISAs

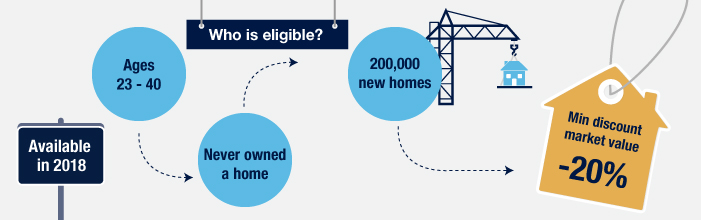

Starter Homes scheme

In March 2015, the government proposed a new Starter Homes Initiative. In January this year, it said work on the new scheme had commenced.

In March 2015, the government proposed a new Starter Homes Initiative. In January this year, it said work on the new scheme had commenced.

This will see the creation of around 200,000 new ‘affordable’ homes, sold at a minimum discount of 20% to first-time home buyers aged between 23 and 40. Construction of these homes started in January 2017 – and the properties could be ready to sell as early as January next year.

There’s a £250,000 price cap on homes available under the scheme, rising to £450,000 if you’re buying in London.

Beware though developers build homes to make money so expect low specifications, small sizes ad corners to be cut.

Shared Ownership.

Shared Ownership schemes allow you to purchase just share of a home (between 25% and 75%) from a local Housing Association and pay rent – up to 3% – on the part you don’t own.

Under a process known as ‘staircasing’ you’ll then be given the chance to buy back chunks as and when you can afford to until you own 100% of the home. These chunks will be priced at the home’s current market value as assessed by the Housing Association. You will also have to pay a valuer’s fee each time.

To qualify for Shared Ownership, your household income must not exceed £80,000 or £90,000 if you’re buying in London.

Housing Associations have strict rules and eligibility can be a problem if you do not have enough “need” as they define it.

The application process is tortuous at best and you can only buy the properties they have on offer in the locations they have built in.

More here http://www.zoopla.co.uk/shared-ownership/

Joint Equity Shared Home Ownership

So how does Joint Equity Shared Home Ownership compare?

As you know the Resident Partner buys 50% of the home and Joint Equity contributes the other 50%.

As you know the Resident Partner buys 50% of the home and Joint Equity contributes the other 50%.

- It’s a simple to understand scheme based on real Partnership between the Resident Partner and the Investment Partner.

- You can use your Help to Buy or Lifetime ISA to buy your Share as long as you have a mortgage as well.

- You cannot staircase above 50% but you can offer to buy out the Investment Partner 50%.

- If you sell your Share the Investment Partner may buy it from you and the gain you make is all yours.

- You pay a Non Resident Partner payment for the 50% you do not own, the same as the Housing Association rent, but with Joint Equity its not a rent and there are no rental conditions attached.

Joint Equity does build homes for sale in the Joint Equity Shared Home Ownership scheme but because we are 50% Partners with the Resident Partner we build real homes for people to live in, to high specifications, with large airy rooms. We build for the future value of our Share not for the sale price today and walk away from the future value like developers and builders.

But Joint Equity will also join with you to buy any second hand home that you like and want to live in. Its not for nothing we say

Any home, any where.

Finally we are your Partners as long as you stay with Joint Equity and we are always here when you need help and advice with anything to do with your home, we will also contribute to improvements that raise the value of your home.

So Joint Equity is simple, easy to live with and a real Partnership and that makes living in your own home with our help rewarding, profitable and secure.

Some of our Partners have been with us over 10 years now and say they never want to leave.

Retired and still renting – a concerning trend

Joint Equity now helps retired people who are trapped in rental properties buy a home of their own. We have always helped first time buyers and divorced and separated but the demand from older would be buyers who have perhaps been refused mortgages or believe they will never have the security of their own home is overwhelming.

In the 2011 census there were 4.2m households living in private rented accommodation. 50% of the head of household were in the 50 to 75 age group – that is over 12m households. 50% of these people declared themselves as economically inactive. The majority said this was because they were retired. That is a staggering 3m households.

In the 2011 census there were 4.2m households living in private rented accommodation. 50% of the head of household were in the 50 to 75 age group – that is over 12m households. 50% of these people declared themselves as economically inactive. The majority said this was because they were retired. That is a staggering 3m households.

In the 50 to 75 age group just over 25% were renting and – using the same proportion of social to private sectors. This suggests that over 350,000 households are retired and living in the private rented sector.

“At later stages in life, where security and peace of mind is even more of a priority, it’s concerning that such a significant percentage of our retired population is having to endure the uncertainty, and many other issues, that come with renting a property, “ says Brad Bamfield CEO of Joint Equity.

“There are so many unappealing aspects of rented living – the prospect of having to regularly move, the upheaval, the concerns about rising rent prices. A priority must be to educate people more about the alternative home ownership options available to them. There are new ways to escape the rental market, take control of your housing finances and own your own home.”

If any of the following questions strike a chord with you, as it does many of our current Resident Partners over a “certain” age, and you answer yes then you need to read on and see how Joint Equity can help you now because if you can afford to rent you can afford to buy with Joint Equity.

- Are you retired and living in rented property?

- Do you dislike the insecurity of rented accommodation?

- Worried about future rent rises?

- Do you have savings that earn you next to nothing?

- Do you think you can never live in your own home with all the security that provides?

Joint Equity can help change things for the better.

You own 50% and we own the other 50% in Partnership. So any growth in the property is shared 50/50 between us and when you sell your Share in the property you get your deposit back as well.

And we do this often for less than the cost of renting.

Remember we are not your landlord we are you Co-owning Partner and its absolutely your home with complete security to stay there as long as you want.

Your investment in your home can be passed on to your heirs together with your share of the increase in value, we are not Equity Release taking great chunks of your value. Nor do we interfere in your life while you live in your home however, we are always available 7 days a week if you need advice or help with the home – we are you Partner after all.

Brad Bamfield CEO of Joint Equity said “the retired renting sector is very important to us as security becomes more important the older you become. We all remember when we were young nothing was frightening and moving every year or so was exciting. “

Brad Bamfield CEO of Joint Equity said “the retired renting sector is very important to us as security becomes more important the older you become. We all remember when we were young nothing was frightening and moving every year or so was exciting. “

“This is not the case when you are over 60 when change and upheaval, usually not through your choice but usually imposed by your landlord, is frightening, difficult and deeply upsetting.”

“Joint Equity offers a real alternative to many people in this sector offering peace of mind, security and a real Partnership for the future years.”

Joint Equity offers an alternative for retired people living in rented accommodation and a viable, secure way of owning your own home. For more information find out about how to become a Resident Partner www.jointequity.co.uk and check out our video page https://www.jointequity.co.uk/videos/ for a real life Resident Partner and her experience.

Sources: Housing Census headlines here

Shared Home Ownership rises by 130% in 6 years

A new report from mover conveyancing services provider, My Home Move, has found that the number of shared home ownership purchases increased by over 130% in the last six years.

The Government shared ownership scheme, which was re-launched eight years ago via HomeBuy Direct, has grown in popularity as house prices across the country have risen by nearly 30% since 2011. Having analysed over 100,000 of its home buyer records, My Home Move discovered that shared home ownership purchases account for around 1% of property transactions year each, with nearly one in five (17%) being purchased by first-time buyers.

The Government shared ownership scheme, which was re-launched eight years ago via HomeBuy Direct, has grown in popularity as house prices across the country have risen by nearly 30% since 2011. Having analysed over 100,000 of its home buyer records, My Home Move discovered that shared home ownership purchases account for around 1% of property transactions year each, with nearly one in five (17%) being purchased by first-time buyers.

At Joint Equity we have found that over 58% of applicants are First Time Buyers with 33% in the divorced and separated and 9% in the retired-renting sectors.

Doug Crawford of HomeBuy says: “For many, the prospect of buying a home outright is still a pipe dream, as prices have risen by around £60,000 since 2011, meaning that a home in the UK now costs an average of £217,000, or if you’re looking to buy in London, nearly £500,000. It is no wonder that solutions like shared home ownership have grown in popularity, and by the end of 2017 we would expect shared ownership transactional volumes to account for more than 1% of all activity – especially as many lenders are now more willing to lend on shared ownership schemes, which historically only a small number of building societies would.”

As there were 1,057,340 residential purchases in England last year a volume of 1% is 10,500 which Brad Bamfield, CEO of Joint Equity, noted is 25% below the target of 135,000 the Government announced in the 2015 Autumn Statement and the announcement tin the 2016 Budget that 13,000 new shared home ownership properties would be brought forward into the 2016 2017 round.

The research also revealed that, on average, the age of those buying a shared ownership home has decreased, with those in their mid-thirties now accounting for the majority of purchases; while between a third and a half of all shared ownership transactions take place in London and the South East each year.

The research also revealed that, on average, the age of those buying a shared ownership home has decreased, with those in their mid-thirties now accounting for the majority of purchases; while between a third and a half of all shared ownership transactions take place in London and the South East each year.

Doug continued: “Whereas six years ago it was those in their 40s who looked to buy a shared ownership home, today it is those in their 30s – thanks in part to the Help to Buy: Shared Ownership scheme.”

Brad Bamfield also says “Joint Equity has found that our age range of applicants for partnership in the Joint Equity Shared Home Ownership Scheme is between 25 and 75 with the youngest applicant just 21. It is clear that shared home ownership and especially our Scheme with the total emphasis on Partnership in Ownership is easily understood and very acceptable to our potential Resident Partners.”

The target Joint Equity has is to add 25,000 Joint Equity Shared Home Ownership homes a year once we have established adequate private funding sources but Brad Bamfield says “our target of 25,000 homes will only scratch the surface of the demand which has built up over the last 10 years and our research shows a past demand of nearly 500,000 which is growing by around 75,000 homes a year. The difference between the Joint Equity and the Government schemes just about is we will support “any home, any where” and focus on second hand property, as we do not feel new build is of sufficient standard or size to give long term investment security to our Partners. The other major drawback to Buy to Let is that the ownership is leasehold until the Government loan is paid off then you have to buy the freehold.”

The target Joint Equity has is to add 25,000 Joint Equity Shared Home Ownership homes a year once we have established adequate private funding sources but Brad Bamfield says “our target of 25,000 homes will only scratch the surface of the demand which has built up over the last 10 years and our research shows a past demand of nearly 500,000 which is growing by around 75,000 homes a year. The difference between the Joint Equity and the Government schemes just about is we will support “any home, any where” and focus on second hand property, as we do not feel new build is of sufficient standard or size to give long term investment security to our Partners. The other major drawback to Buy to Let is that the ownership is leasehold until the Government loan is paid off then you have to buy the freehold.”

More from Joint Equity www.jointequity.co.uk

Joint Equity Co-Ownership – an alternative way

In this article Brad Bamfield, Joint Equity CEO, discusses Joint Equity Shared Home Ownership – a new way to buy a home for home owners and new opportunities for investors.

There are over 1 million people trapped in the rental market with all the wasted money and insecurity that entails when they would rather live in their own home. There are also many investors falling out of love with Buy to Let who still want to invest in the UK residential property market. Now we have a solution that brings benefits to both these parties.

There are over 1 million people trapped in the rental market with all the wasted money and insecurity that entails when they would rather live in their own home. There are also many investors falling out of love with Buy to Let who still want to invest in the UK residential property market. Now we have a solution that brings benefits to both these parties.

For over 35 years I have been a builder and developer selling well designed flats and houses that I am very proud of and my buyers are happy to live in.

But I have always been aware that for every home I built 10+ people were disappointed either being unable to get a mortgage or not being able to raise a high enough deposit. This meant they remained trapped in rented accommodation.

In my time I have lived in rented houses and I hated both the insecurity of a Short Hold Tenancy and the restrictions and interference of the landlord and agent. And if I hated it, so do many others.

I really do not want anyone who does not want to, to have to live in a rented property so my vision was to devise a way to help those who needed help to get a home of their own.

Big ask? You are right but I was convinced there was a way to help people move out of rented into home ownership.

In 2006 I devised, invented, designed (call it what you will) a new structure that combines traditional approaches to buying and investing in homes in a new way – Joint Equity Co-Ownership.

As my personal targets have always been the “shoot for the moon” types, I have set the goals for Joint Equity as

- To help 25,000 people every year buy their own home and

- To provide investors with better returns and less risk than Buy to Let.

- Provide a real Ethical Investment opportunity

Now with Joint Equity Bonds we have the means to attract sufficient investors to make this happen. So now my goals are within our grasp.

We can easily see what our Resident Partners get from Joint Equity.

- Security,

- A home of their own,

- No landlord or letting agent

- A knowledgeable Partner who is on your side

- A 50% share of the growth in house prices.

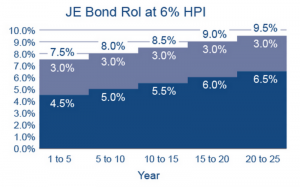

But what do Joint Equity Bond investors get?

- Their money back at the end of the Bond.

- Secure investment paying a good rate of return which increases the longer they hold the investment. I call this an escalating rate of return and I am told its innovative.

- A terminal bonus that is either fixed and accrued annually.

- No hassles associated with being a landlord or having agents always asking for more money. No voids, damage, late payments, problem tenants, increasing legislation, changing tax regimes. (I could go on but there really is none of the problems with the traditional Buy to Let process).

Investors also get the big win with Joint Equity – the feel good factor, the personal satisfaction that comes from knowing that they are helping people who without their investment could never have the security of living in their own home. The essence of Ethical Investments.

So is my vision to help 25,000 people a year move into their own homes and to deliver good returns to investors achievable while being ethical?

Absolutely.

I am a hard headed developer but I also know there are 1,000’s of people (our investors) who really do want to get involved and help others while making good returns on their money.

It’s a market solution for a social need – the perfect definition for Ethical Investment.

Brad Bamfield

CEO & Founder Joint Equity

More information www.jointequity.co.uk

Homeownership is always important to UK people

A new UK-wide study from first direct highlights the meaning of success to people across the UK and reveals what they deem as ‘successful’ and important throughout different stages of their lives.

The research shows that young Brits aren’t deterred by the ever-increasing challenge of getting on the property ladder and are more keen to own their own homes than their parents.

Ambitious and unphased

According to the latest official figures, the typical home in the UK costs £216,674 – up by 6.9% from the previous year. As a result of the rise, the BBC recently reported that first-time buyers would need to find an average deposit of about £33,000 for a mortgage on such a property.

In order to save for a deposit of this amount, first time buyers on the average UK salary of around £27,000 would need to save their full pre-tax wage for at least 14 months.

In order to save for a deposit of this amount, first time buyers on the average UK salary of around £27,000 would need to save their full pre-tax wage for at least 14 months.

Despite the ever increasing challenges, the research suggests that young Brits are more determined than most to achieve the home ownership dream with 71% of 18-34 year olds saying it is important to them to own their own property against just 66% of those aged 45-54.

A place to call your own – Young Brits’ vision of success

The majority of millennials define success as simply having something you can call your own – 66% typically class success in the property market as owning your own home and funding it independently (41%); not having a large (20%) or expensive (13%) property.

However, owning your own home doesn’t come without being financially stable – 86% of those between 18-34 say admit this is important to them with the vision of achieving this between the ages of 25-34.

Interestingly, for 18-24 year olds; owning the perfect family home sits high on the list of life goals too. This age group are the most likely (than any other age group) to define success within the property market as ‘a great family home’ (51%), which they have funded independently (46%) – in comparison to less than a third (32%) of 35-44 year olds who believe this.

When taking a wider look at the whole of the UK, first direct found that the majority of Brits (64%) believe simply having a place to can call your own, no matter where it is or what it looks like, is the vision of success when it comes to property. Similarly, over a third (36%) also believe that success comes from funding your home independently.

‘Family is the heart of the home’ – second on the success scale is to have a great family home (37% said this is the measure of a successful home) and a similar amount of Brits (36%) measure a successful home by the desirability of the area. Brits admit having a large (12%) or expensive property (8%) is of little value when it comes to a home with both revealed as some of the least important measures of a successful home.

Joint Equity Shared Home Ownership can help many people make the break from renting or living with parents who would be excluded from home ownership because they have insufficient deposit or their income is too low for the new mortgage affordability tests.

More here

Rents rise – but slower although additional upward pressure is coming

HomeLet has revealed that 2016 rents in the UK rose on average 1.7% in December – less than half the 3.8% rate of rental price inflation in December 2015.

According to the report, landlords agreeing new tenancies during December achieved more modest increases in rent than in previous months, with the annual rate of rental inflation falling from 2.9% in November.

Across the UK as a whole, the average rent for a new tenancy commencing in December was £892 per month, compared to £877 in December 2015. In Greater London, rents rose from £1,478 to £1,508 over the same period, a smaller percentage increase but still a higher rental value.

HomeLet’s Rental Index data for 2016 reveals a year of two halves: during the first six months of the year, annual rental price inflation was consistently 4% or higher, peaking at 4.7% in June. In contrast, the second half of the year saw rental price growth steadily reducing to the lowest rate of increase in the final month of year.

In some areas of the country the slowdown over the year was even more marked. Rents in Greater London were 2% higher in December compared with 6.8% at the mid-year point.

Rental price inflation is still running ahead of general inflation as measured by the consumer price index, but the slowdown seen during the second half of 2016 raises questions as to the extent to which landlords will be able to raise rents further during 2017. While some property analysts have predicted strong rental price appreciation in the years ahead, particularly relative to house price growth, landlords, in recent months, looked for much more modest increases. This could prove significant during 2017, with impending tax changes beginning in April potentially reducing the returns available from buy-to-let property investment.

Rental price inflation is still running ahead of general inflation as measured by the consumer price index, but the slowdown seen during the second half of 2016 raises questions as to the extent to which landlords will be able to raise rents further during 2017. While some property analysts have predicted strong rental price appreciation in the years ahead, particularly relative to house price growth, landlords, in recent months, looked for much more modest increases. This could prove significant during 2017, with impending tax changes beginning in April potentially reducing the returns available from buy-to-let property investment.

While it has been suggested landlords impacted by the reduction in mortgage interest tax relief will seek to recoup this additional cost from tenants, this may not be feasible if lower rental price inflation persists. Further cost pressures to come include the potential impact of November’s announcement of a ban on letting agents’ fees, which could see landlords asked to meet such expenses in connection with renting their property to new tenants.

While it has been suggested landlords impacted by the reduction in mortgage interest tax relief will seek to recoup this additional cost from tenants, this may not be feasible if lower rental price inflation persists. Further cost pressures to come include the potential impact of November’s announcement of a ban on letting agents’ fees, which could see landlords asked to meet such expenses in connection with renting their property to new tenants.

Across the UK as a whole, rent accounted for an average of 28.0% of tenants’ household income before tax, down slightly on last December’s figure of 28.4%. In London, the equivalent figures are 31.0% and 31.2%.

Martin Totty, HomeLet’s Chief Executive Officer, said: “While demand for rental property remains strong, landlords always have to be mindful of tenants’ ability to pay higher prices. The data recorded by the HomeLet Rental Index during the second half of last year suggests we have now begun to approach an affordability ceiling, particularly in areas of the country where rental price inflation was previously highest.

While the industry has speculated that landlords will increase rents to mitigate the impact of factors such as the impending reductions in mortgage interest tax relief, this may prove problematic given the pricing trends we’re currently seeing in the market and the potential for higher inflation and a squeeze on real earnings in 2017.

The private rented sector is now having to cope with a series of disruptive elements, just at a time of great economic uncertainty, and amid a continuing systematic imbalance between supply and demand for residential property. The assumption that landlords have sufficient means to bear higher costs will soon be tested. Tenants must hope they do.”

The regional picture for 2016

Northern Ireland, where rents were 6.4% higher in December than in the same month of 2015, saw the strongest rental price inflation of any region in the UK last year, followed by the North-East of England (4.9%) and Wales (3.9%). Just one region saw a fall in rents over the same period, with the East Midlands recording a drop of 0.4%.

Regions that were more likely to show higher rental increases during the first half of the year saw a more marked pull-back in the second six months. This was led by London, but the South-East saw rental price inflation fall from 4% in June to just 1.7% in December, while the East of England dropped from 5.5% to 2.5%.

Home ownership is still hard to achieve.

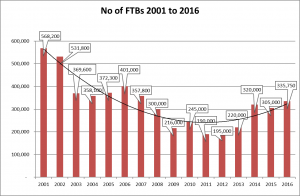

Research by Halifax says there were more first-time home buyers in 2016 than at any time since the start of the financial crisis, however that is well down on the numbers who were able to buy homes before 2007.

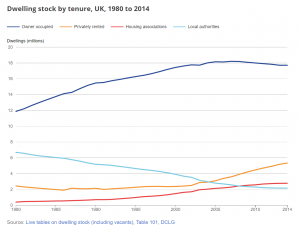

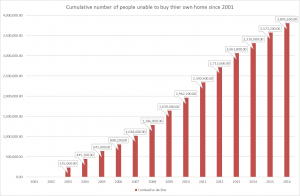

Joint Equity tracks first time buyer numbers because it is one of our primary sectors, the others are divorced and separated and retired renters, and we think the best way to understand what has happened to the market is to look at it graphically.

This graph shows the quite dramatic decline from the 2001 high but this does not tell the real story and that is the number of people, which grows each year, that are unable to live in their own home.

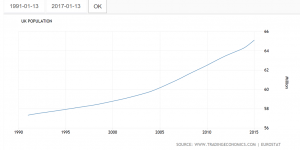

The average FTBs buying their own home from 1991 to 2000 was 507,233 every year. As our population grows from 57.5M in 1991 to 65M in 2015 it is reasonable to assume the real number of First Time Buyers wanting to live in their own home almost rises.

Now we are not statisticians (fortunately) and we accept that there are many factors that could distort our assumptions but we are simple people here at Joint Equity and we

look at things simply as probably this tells us the clearest story.

If the numbers of FTB’s in the early 1990’s was an average of 0.882% of the total population then if we assume the average number who want their own home is constant the number of FTBs in 2015 who want their own is 0.882% of 65M which is 573,390.

That means that in 2015 approximately 237,640 people wanted to buy their own home who could not, who were denied access to the home ownership market.

So where did they go as they must live somewhere after all? As we see from the media many go back home to Mum and Dad and the rest have to go into private or social rented. This is supported by the growth in the private rented sector over the last 20 years.

Extrapolating the fairly steady growth from 2005 to 2014 for 2015 and 2016 we now have 5,800,000 privately rented homes in England an increase of 2,700,000 since 2005.

So it’s a fair assumption that the decrease in owner occupation and increase in population has been accommodated in the private rental sector and that means the Buy to Let predominantly.

Returning to the decline in Fist Time Buyers we can assess the total number of people who would like to buy their own home and cannot as the difference between the average demand (570,000) and the take up of FTB homes in 2016 (335,750) which is 234,250 people who cannot buy their own home. If we do this for each year of the decline below the average demand, then we see 3,800,000 people have been unable to buy their own home since 2001. Which corresponds to the growth in Buy to Let.

Halifax also found the average first-time deposit more than doubled compared with 2007 to stand at more than £32,000 and 60% of first first-time buyers’ mortgages were for 25 years or longer, up from 36% a decade ago.

Other reports in 2016 have found the average age that people buy their own home is also rising and is now around 33.

With the constant attacks on Buy to Let landlords (see Another Blow to Buy to Let Investments here) the numbers of BtL properties available will be static (best case) or decline as the combination of increased stamp duty, lower tax allowances and higher mortgage criteria send investors elsewhere.

What we need is

- Another way for investors to participate in the UK residential property market that is simple, secure and pays reasonable returns.

- A financially viable alternative way for the people who want to live in their own home top do so.

Joint Equity shared home ownership scheme offers a solution to both home owners and investors.

Through Joint Equity Bonds investors can invest securely in UK residential assets at reasonable returns with attractive terminal bonuses.

The Joint Equity scheme offers a new alternative for aspiring home owners who cannot buy their own home because their income is too low or their deposit is too small to provide a reasonable mortgage for the home they want.

More information on Joint Equity www.jointequity.co.uk