Joint Equity Co-Ownership – an alternative way

In this article Brad Bamfield, Joint Equity CEO, discusses Joint Equity Shared Home Ownership – a new way to buy a home for home owners and new opportunities for investors.

There are over 1 million people trapped in the rental market with all the wasted money and insecurity that entails when they would rather live in their own home. There are also many investors falling out of love with Buy to Let who still want to invest in the UK residential property market. Now we have a solution that brings benefits to both these parties.

There are over 1 million people trapped in the rental market with all the wasted money and insecurity that entails when they would rather live in their own home. There are also many investors falling out of love with Buy to Let who still want to invest in the UK residential property market. Now we have a solution that brings benefits to both these parties.

For over 35 years I have been a builder and developer selling well designed flats and houses that I am very proud of and my buyers are happy to live in.

But I have always been aware that for every home I built 10+ people were disappointed either being unable to get a mortgage or not being able to raise a high enough deposit. This meant they remained trapped in rented accommodation.

In my time I have lived in rented houses and I hated both the insecurity of a Short Hold Tenancy and the restrictions and interference of the landlord and agent. And if I hated it, so do many others.

I really do not want anyone who does not want to, to have to live in a rented property so my vision was to devise a way to help those who needed help to get a home of their own.

Big ask? You are right but I was convinced there was a way to help people move out of rented into home ownership.

In 2006 I devised, invented, designed (call it what you will) a new structure that combines traditional approaches to buying and investing in homes in a new way – Joint Equity Co-Ownership.

As my personal targets have always been the “shoot for the moon” types, I have set the goals for Joint Equity as

- To help 25,000 people every year buy their own home and

- To provide investors with better returns and less risk than Buy to Let.

- Provide a real Ethical Investment opportunity

Now with Joint Equity Bonds we have the means to attract sufficient investors to make this happen. So now my goals are within our grasp.

We can easily see what our Resident Partners get from Joint Equity.

- Security,

- A home of their own,

- No landlord or letting agent

- A knowledgeable Partner who is on your side

- A 50% share of the growth in house prices.

But what do Joint Equity Bond investors get?

- Their money back at the end of the Bond.

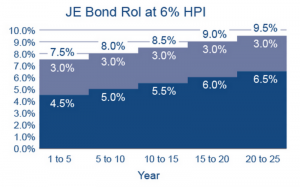

- Secure investment paying a good rate of return which increases the longer they hold the investment. I call this an escalating rate of return and I am told its innovative.

- A terminal bonus that is either fixed and accrued annually.

- No hassles associated with being a landlord or having agents always asking for more money. No voids, damage, late payments, problem tenants, increasing legislation, changing tax regimes. (I could go on but there really is none of the problems with the traditional Buy to Let process).

Investors also get the big win with Joint Equity – the feel good factor, the personal satisfaction that comes from knowing that they are helping people who without their investment could never have the security of living in their own home. The essence of Ethical Investments.

So is my vision to help 25,000 people a year move into their own homes and to deliver good returns to investors achievable while being ethical?

Absolutely.

I am a hard headed developer but I also know there are 1,000’s of people (our investors) who really do want to get involved and help others while making good returns on their money.

It’s a market solution for a social need – the perfect definition for Ethical Investment.

Brad Bamfield

CEO & Founder Joint Equity

More information www.jointequity.co.uk