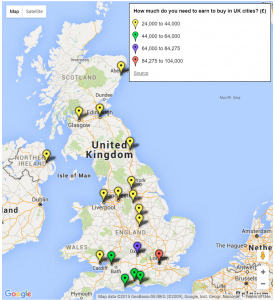

How much do you need to earn to buy a home? It ranges from £24k to £97k

A ‘chronic shortage’ of homes for sale in Britain’s cities has helped to push house prices up in urban areas by more than 10 per cent this year. It means buyers need to earn significantly more than a typical wage before they can own a city home.

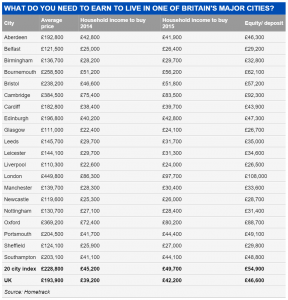

New figures suggests that out of 20 major cities in Britain, the average household income needed to afford a home with a typical 76 per cent mortgage is £49,700, up from £45,000 a year ago.

But the range is significant – from less than the average wage at £24,000 in Liverpool, to a staggering £80,200 in Oxford and almost £100,000 in London.

The research by Hometrack found those buying in Liverpool need a smaller deposit at £26,500, compared to £88,700 in Oxford and £108,000 in London.

The research by Hometrack found those buying in Liverpool need a smaller deposit at £26,500, compared to £88,700 in Oxford and £108,000 in London.

The weakest rate of growth has been Aberdeen, where average house prices have dropped 2 per cent following a 12 per cent increase the previous year.

The city with the strongest turnaround in the past year has been Glasgow, where growth has jumped from 1.8 per cent to 8 per cent as prices recover from a relatively low level in one of the most affordable cities covered by the research.

Hometrack blamed a lack of supply, created by strong demand from investors along with a low number of existing homeowners who are moving. The latter group accounts for 33 per cent of housing sales today compared to 50 per cent in 2007.

Richard Donnell, director of research at Hometrack, said: ‘The scarcity of homes for sale looks set to remain a feature of the market in 2016. This will only ease once we see greater levels of output from home builders and renewed activity among existing mortgaged homeowners.

‘Questions about the sustainability of house price growth are being raised as house prices accelerate on growing scarcity and lower sales volumes, especially in the high growth markets such as London.

However, there is a glimmer of hope for buyers as investor demand weakens next year, Hometrack predicts. This will be due to the changes in stamp duty rates for second homes and the tax relief changes for landlords.

However, there is a glimmer of hope for buyers as investor demand weakens next year, Hometrack predicts. This will be due to the changes in stamp duty rates for second homes and the tax relief changes for landlords.

Mr Donnell added: ‘Assuming the first interest rate rise is in the second half of 2016 then we expect 7 per cent growth in city level house prices over 2016 with housing transactions broadly flat. This is based on a slowdown in growth across London as affordability pressures and lower investor demand ease the upward pressure on house prices.

‘Earlier and faster rate rises than those assumed by the market would reduce the scale of house price growth as they would further impact investor demand and mortgage affordability.’

The Bank of England is widely expected to raise interest rates in the second half of next year from the historical low of 0.5 per cent as the economy improves.

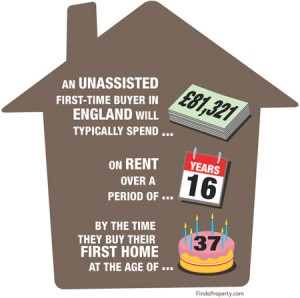

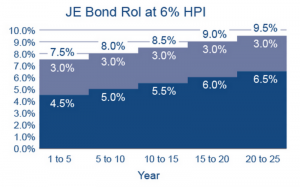

Brad Bamfield, CEO of Joint Equity says “buying with Joint Equity means your deposit is lower at 5% of house price as a minimum and we use your ability to pay rent as the affordability factor. So if you have paid rent for 12 months or more we will support you up to £100 per month more than that rent.”

This means most people who can afford to rent can afford to buy with Joint Equity.

Article source This Is Money, full article here.