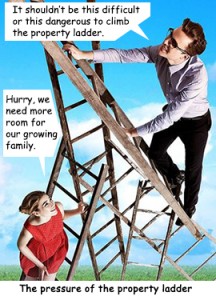

46% of First Time Buyers consider Shared Home Ownership

Almost half (46%) of first time buyers are considering turning to shared equity and shared ownership schemes to enable them to buy their first home, according to research from Lloyds Bank.

Almost half (46%) of first time buyers are considering turning to shared equity and shared ownership schemes to enable them to buy their first home, according to research from Lloyds Bank.

Of these, one in four (26%) said affordable housing schemes were their only option for getting onto the property ladder and they would not be able to buy a home otherwise.

One in four (24%) said it allowed or would allow them to buy in an area which would otherwise have been unaffordable.

The economic downturn has also had an impact on how people view affordable housing schemes, with one in six (15%) of first time buyers saying they would not have considered the schemes previously, but have changed their mind due to the economic conditions.

Eight in ten (81%) first-time buyers claim to have a basic or good understanding of shared ownership schemes, although this is less for shared equity schemes (64%).

Brad Bamfield CEO of Joint Equity said: “Over the past few years the shared home ownership concept has become more established and understood. However most people have only heard of the Government and Housing Association schemes and developers own schemes or Help to Buy for new houses.

Brad Bamfield CEO of Joint Equity said: “Over the past few years the shared home ownership concept has become more established and understood. However most people have only heard of the Government and Housing Association schemes and developers own schemes or Help to Buy for new houses.

“Government schemes still have a stigma attached and the social engineering aspects that Housing Associations apply put off many people. Of course developers only use shared home ownership to shift the rump of developments they cannot sell in any other way and buyers know that and of course are not impressed.”

What many people don’t know is that there is an alternative privately financed shared home ownership option which delivers quality homes to want-to-be homeowners – with no social agenda.”

Over the last 7 years Joint Equity has become a life style option for our Owner Partners which provides many advantages over other home ownership options.

Find out more here www.jointequity.co.uk

Sources: Lloyds TSB read research here